e-fundresearch.com: "Mr Morgan Harting, you are the fund manager of the ACMBernstein Emerging Market Multi-Asset fund (ISIN: LU0633140644). Since when are your responsible for the fund management?"

Harting: “I have been the co-team leader of ACMBernstein’s Emerging market Multi-Asset portfolio management team since the inception of the fund in June 2011.”

e-fundresearch.com: "Which benchmark do you adhere to?"

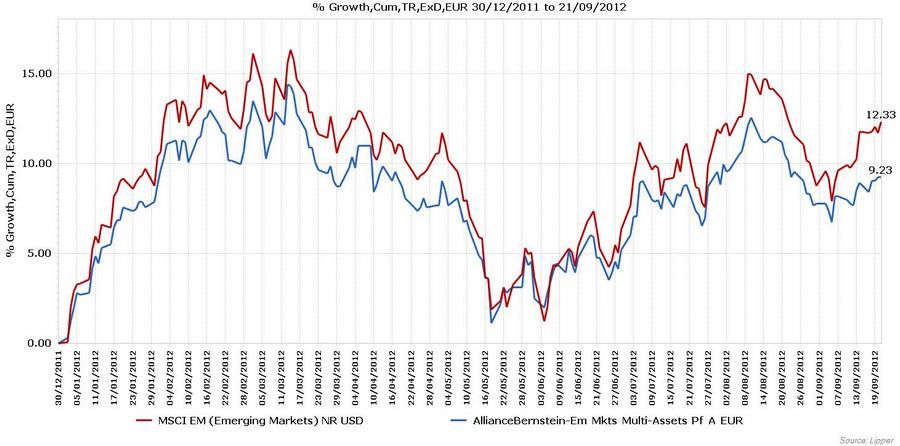

Harting: “We measure our performance versus the MSCI Emerging markets Index.”

e-fundresearch.com: "Are you also responsible for other funds at the moment?"

Harting: “Our Emerging market Multi-Asset fund is my primary responsibility. I am also a member of the Global Value team at ACMBernstein which means I participate in research review meetings with our fundamental analysts.”

e-fundresearch.com: "What is the total volume that you manage in all your funds?"

Harting: “Emerging markets are an important and significant part of our overall firm AUM. We have been managing emerging markets investments in equity and fixed income for over 15 years and currently manage around €28bn across dedicated EM and broad global strategies. In emerging markets multi-asset we currently have around €70m.”

e-fundresearch.com: "Regarding the performance: which performance did you achieve since the beginning of the year and in the years 2007-2011? Absolutely and relatively to the relevant benchmark?"

Harting: “We launched the fund in June 2011 with the aim of providing equity-like returns with lower volatility. That was obviously a tough time to launch a new equity focused fund but the uncertainty of markets in late 2011 meant we had the opportunity to prove what we set out to achieve. By the year end we had outperformed the MSCI Emerging Markets index and this year-to-date in 2012 we are approximately inline – and all at around 25% lower volatility than the benchmark.”

e-fundresearch.com: "How content are you with your own performance in the last years and this year?"

Harting: “Performance has been as we hoped for and expected – as markets rally we aim to participate but not necessarily outperform provided that when they fall we can dampen the downside. This is what has contributed to our outperformance since inception.”

e-fundresearch.com: "How are you able to deliver added value for your investors with your performance?"

Harting: “Because we seek equity-like returns with lower volatility we are aiming for a stronger risk-adjusted return than the index - and in the last past year we have outperformed equities with around 25% less risk. We believe this approach can lead to ultimately better returns over the long term. Our unconstrained approach means we can target investment opportunities across equity and debt. We are also dynamic and flexible in our allocation to equity and debt – moving away from equities as markets get riskier but returning as the outlook is more positive.”

e-fundresearch.com: "How long have you been a fund manager already?"

Harting: “I moved to ACMBernstein in 2007 to become a portfolio manager. Previously, I was a Senior Director at Fitch focusing on emerging markets countries.”

e-fundresearch.com: "What were your biggest successes and your biggest disappointments in your career as fund manager?"

Harting: “Been given the opportunity to develop and launch our emerging markets multi-asset fund was certainly a highlight. It is a great opportunity to allow investors to participate in the exciting world of emerging markets while giving them some comfort by focusing on risk as well as return. In terms of disappointments – it would have been interesting to have been managing this fund in 2008 as we believe our approach could have saved investors quite a lot of pain.”

e-fundresearch.com: "What kind of capital market situation do we have at the moment? How do you act in this environment?"

Harting: “Investors remain traumatized by the experience of the global financial crisis. Emerging market equity valuations are near their lowest level in history, though fundamentals are much improved, particulalry versus the developed world. So we're able to pick up some tremendous bargains in the equity market, but it's helpful to own some debt as well in order to moderate the near-term volatility and provide some downside protection.”

e-fundresearch.com: "What are the special challenges in this environment?"

Harting: “Finding sources of safety that aren't completely crowded and overpriced. US treasuries pay almost nothing and low-volatility emerging equities trade at huge premiums to the broad emerging equity opportunity set. “

e-fundresearch.com: "What objectives do you have till the end of the year and in the mid term for the upcoming 3 to 5 years?"

Harting: “For the rest of this year we will continue to focus on navigating these turbulent markets and positioning the fund to participate when it can and protect on the downside. In the longer term our research suggests that the potential for upside in emerging-markets is greater for equities than fixed income. “

e-fundresearch.com: "Do you model yourself on someone? Any ideals?"

Harting: “I'm fortunate to work with a team of very smart colleagues who are relentlessly focused on meeting our clients investment objectives. I try my best to keep up with them. “

e-fundresearch.com: "What motivates you in your job?"

Harting: “We have a very clear investment objective. Meeting it requires being in the flow of constantly evolving market conditions while always being alert to new ideas. It's exhilirating.”

e-fundresearch.com: "What else do you want to achieve or do you have any further aims as a fund manager?"

Harting: “I'll be very happy to look back on our results 20 years from now and see that we've met our objectives.“

e-fundresearch.com: "What other profession would you have taken interest in, apart from becoming a fund manager?"

Harting: “I was a Graduate Teaching Fellow in International Economics at Yale, and there was a time when I could have envisioned an academic career.”

e-fundresearch.com: Many Thanks!