e-fundresearch.com: When did you take over the responsibility of managing this fund?

Odeniyaz Dzhaparov: 01.01.2008

e-fundresearch.com: What is the current size of the fund?

Odeniyaz Dzhaparov: 338.7mn EUR

e-fundresearch.com: What is the total amount of assets you manage currently?

Odeniyaz Dzhaparov: 1.66bn EUR

e-fundresearch.com: How long have you been in the business as a fund manager?

Odeniyaz Dzhaparov: 20 years

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Odeniyaz Dzhaparov:

Active portfolio management: At the core of our active investment philosophy and investment process lies our belief that capital markets and especially Eastern European markets are not entirely efficient: not all publicly available information is correctly considered by the market all the time.

Information advantages through pro-prietary macro and micro research:

With our own comprehensive research, we identify the most important factors for market prices and spot inefficiencies in the market. These factors comprise financial as well as non financial aspects (e.g. ESG factors, carbon footprint and reputational risks/exclusions).

Systematic and transparent investment process:

We ensure this through disciplined, clear and yet flexible investment and decision-making processes. This process is centered on the timely recognition of investment themes and trends and the resulting selection of securities with above average share price potential.

Accountability on research & construction level:

The team structures and the fact that each fund is managed by one portfolio manager ensure a clear accountability on the research as well as on the portfolio construction level. The results of this process are constantly reviewed by our integrated portfolio monitoring and risk management process.

Investment style: With our investment objective and investment universe in mind, our investment style can be best described as a blend of value and growth investing with a sound bias toward growth companies. With the help of our investment process described below we try to filter those companies with sound fundamentals which are temporarily undervalued taking their earnings growth potential into account. The fund is actively managed with an emphasis of bottom up selection of stocks based on fundamental research focused on GARP – growth at a reasonable price and high conviction.

Investment Process – Overview: In constructing the portfolio for the DWS Osteuropa, we are benchmark aware and not benchmark driven. We construct portfolios by identifying the most attractive sectors and companies in Central & Eastern Europe to invest in and applying a risk framework to these positions in our portfolio construction process. We pursue a combined top-down / bottom-up approach to generate profitable investment strategies and stock picks. The general portfolio construction is based on identified long-term themes and trends which act as rough navigation points.The portfolio management leverages the in-house expertise, not only from the equities team, but also from sector and regional equity specialists and in addition from the combined knowledge of our in-house experts across other asset classes (like Commodities, Fixed Income, Foreign Exchange or Multi Asset) distilled in the CIO view.

Through our integrated process we are able to identify those sectors and single stocks having the most favorable prospects.After constructing the portfolio every single position is constantly monitored. The position monitoring comprises both the top-down and bottom-up view of the investment decision. All single portfolio positions are independently monitored both by the portfolio manager and the responsible sector or regional expert.Investment decisions are documented by the responsible portfolio manager in our proprietary program, Portfolio Builder, before initiating a trade. For each trade a documented investment rationale is mandatory. The investment rationale is stored and can be reviewed by the respective team heads and the compliance department.

Performance reviews with team and senior management take place on a weekly and monthly basis. Data on performance is made available from the Performance Measurement Department on a daily basis. Large performance deviations in single funds and the complete order flow are checked on a daily basis by the responsible team heads. Any deviation from the DWS Investments/DB Advisors house view will be discussed between the portfolio manager and the respective team head.

Odeniyaz Dzhaparov about DWS Osteuropa (ISIN: LU0062756647):

“Eastern Europe is certainly one of the most dynamic regions globally and offers plenty of opportunities. My strong believe is that an ongoing transition and convergence process will spur economic growth. Without any doubt this has not and won’t be a straight forward development, but it should anyhow be beneficial for an active manager with a local footprint.”

Our strengths in Eastern Europe:

- Long-term experience and track record in managing Assets in Emerging Europe.

- Clear Investment-philosophy, transparent decision process and a pronounced risk management.

- Global know-how by leveraging our global DWS platform with multi-cultural, multi-lingual investment teams.

- Local know and support (e.g. UFG in Russia)

- Independent first hand research, globally available research-platform G-Cube

Portfolio Manager – Responsibilities: Odeniyaz Dzhaparov, lead portfolio manager, is fully responsible for the fund, the investment decisions and the performance of his portfolios. He is supported by the Emerging Markets Equity team and manages the fund since January 2008. His Deputy is Robert Kalin, head of the Emerging Markets Equity team. Provided on the following page are the members of the Emerging Markets Equity team. Strictly embedded in his team, Odeniyaz Dzhaparov bears the responsibility and degrees of freedom to implement all relevant investment decisions in his/her portfolios. This includes the steering of the degree of investment; the regional, sector and currency allocation; single stock picks and weightings; the implementation of style and size; the application of derivatives and market timing, while observing the applicable legal and regulatory guidelines.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Odeniyaz Dzhaparov: Since August 2008 the benchmark to the fund is the MSCI EM Europe 10/40 (RI). For earlier performance comparisons this benchmark is applied retroactively. The benchmark was chosen because it reflects the legal limits imposed by the German investment law (and UCTIS III directive) regarding the weight of individual holdings in a mutual fund. The directive constrains the weight of any single group entity, as defined therein, at 10% of a fund’s total assets and the sum of the weights of all group entities representing more than 5% of the fund at 40% of the fund’s total assets. Before the introduction of the MSCI EM Europe 10/40 (RI) no appropriate benchmark was available.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Odeniyaz Dzhaparov:

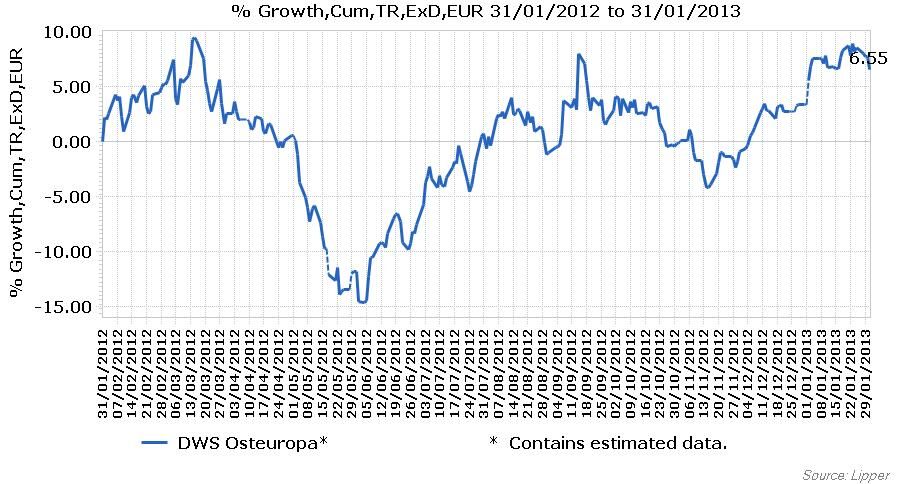

| As of 31.01.2013 | Currency | 1 Year | 3 Year | 5 Year |

| DWS Osteuropa | Euro | 6.55% | 15.49% | -17.48% |

| MSCI EM Europe 10/40 (RI) | Euro | 12.10% | 20.87% | -0.73% |

e-fundresearch.com: Many Thanks!

- When did you take over the responsibility of managing this fund?

01.01.2008

- What is the current size of the fund?

338.7mn EUR

- Do you also manage other funds or mandates?

Yes, retail fund DWS Russia and institutional mandates

- (If yes) What is the total amount of assets you manage currently?

1.66bn EUR

- How long have you been in the business as a fund manager?

20 years

- What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Active portfolio management: At the core of our active investment philosophy and investment process lies our belief that capital markets and especially Eastern European markets are not entirely efficient: not all publicly available information is correctly considered by the market all the time.

Information advantages through pro-prietary macro and micro research:

With our own comprehensive research, we identify the most important factors for market prices and spot inefficiencies in the market. These factors comprise financial as well as non financial aspects (e.g. ESG factors, carbon footprint and reputational risks/exclusions).

Systematic and transparent investment process:

We ensure this through disciplined, clear and yet flexible investment and decision-making processes. This process is centered on the timely recognition of investment themes and trends and the resulting selection of securities with above average share price potential.

Accountability on research & construction level:

The team structures and the fact that each fund is managed by one portfolio manager ensure a clear accountability on the research as well as on the portfolio construction level. The results of this process are constantly reviewed by our integrated portfolio monitoring and risk management process.

Investment style: With our investment objective and investment universe in mind, our investment style can be best described as a blend of value and growth investing with a sound bias toward growth companies. With the help of our investment process described below we try to filter those companies with sound fundamentals which are temporarily undervalued taking their earnings growth potential into account. The fund is actively managed with an emphasis of bottom up selection of stocks based on fundamental research focused on GARP – growth at a reasonable price and high conviction.

Investment Process – Overview: In constructing the portfolio for the DWS Osteuropa, we are benchmark aware and not benchmark driven. We construct portfolios by identifying the most attractive sectors and companies in Central & Eastern Europe to invest in and applying a risk framework to these positions in our portfolio construction process. We pursue a combined top-down / bottom-up approach to generate profitable investment strategies and stock picks. The general portfolio construction is based on identified long-term themes and trends which act as rough navigation points.The portfolio management leverages the in-house expertise, not only from the equities team, but also from sector and regional equity specialists and in addition from the combined knowledge of our in-house experts across other asset classes (like Commodities, Fixed Income, Foreign Exchange or Multi Asset) distilled in the CIO view. Through our integrated process we are able to identify those sectors and single stocks having the most favorable prospects.After constructing the portfolio every single position is constantly monitored. The position monitoring comprises both the top-down and bottom-up view of the investment decision. All single portfolio positions are independently monitored both by the portfolio manager and the responsible sector or regional expert.Investment decisions are documented by the responsible portfolio manager in our proprietary program, Portfolio Builder, before initiating a trade. For each trade a documented investment rationale is mandatory. The investment rationale is stored and can be reviewed by the respective team heads and the compliance department.Performance reviews with team and senior management take place on a weekly and monthly basis. Data on performance is made available from the Performance Measurement Department on a daily basis. Large performance deviations in single funds and the complete order flow are checked on a daily basis by the responsible team heads. Any deviation from the DWS Investments/DB Advisors house view will be discussed between the portfolio manager and the respective team head.

Odeniyaz Dzhaparov about DWS Osteuropa:

“Eastern Europe is certainly one of the most dynamic regions globally and offers plenty of opportunities. My strong believe is that an ongoing transition and convergence process will spur economic growth. Without any doubt this has not and won’t be a straight forward development, but it should anyhow be beneficial for an active manager with a local footprint.”

Our strengths in Eastern Europe:

· Long-term experience and track record in managing Assets in Emerging Europe.

· Clear Investment-philosophy, transparent decision process and a pronounced risk management.

· Global know-how by leveraging our global DWS platform with multi-cultural, multi-lingual investment teams.

· Local know and support (e.g. UFG in Russia)

· Independent first hand research, globally available research-platform G-Cube

Portfolio Manager – Responsibilities: Odeniyaz Dzhaparov, lead portfolio manager, is fully responsible for the fund, the investment decisions and the performance of his portfolios. He is supported by the Emerging Markets Equity team and manages the fund since January 2008. His Deputy is Robert Kalin, head of the Emerging Markets Equity team. Provided on the following page are the members of the Emerging Markets Equity team. Strictly embedded in his team, Odeniyaz Dzhaparov bears the responsibility and degrees of freedom to implement all relevant investment decisions in his/her portfolios. This includes the steering of the degree of investment; the regional, sector and currency allocation; single stock picks and weightings; the implementation of style and size; the application of derivatives and market timing, while observing the applicable legal and regulatory guidelines.

- Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Since August 2008 the benchmark to the fund is the MSCI EM Europe 10/40 (RI). For earlier performance comparisons this benchmark is applied retroactively. The benchmark was chosen because it reflects the legal limits imposed by the German investment law (and UCTIS III directive) regarding the weight of individual holdings in a mutual fund. The directive constrains the weight of any single group entity, as defined therein, at 10% of a fund’s total assets and the sum of the weights of all group entities representing more than 5% of the fund at 40% of the fund’s total assets. Before the introduction of the MSCI EM Europe 10/40 (RI) no appropriate benchmark was available.

- Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?