Archiv-Beitrag: Dieser Artikel ist älter als ein Jahr.

e-fundresearch.com: Mr. Ken Ka-Lam Hu (CIO Fixed Income – BOCHK Asset Management Limited) you are the fund manager of the SOP I SICAV – SOP AnleihenChinaPlus fund (ISIN: LU0776283714). When did you take over the responsibility of managing this fund?Ken Ka-Lam Hu: I have managed the fund since its inception on June 18th, 2012.

e-fundresearch.com: What is the current size of the fund?

Ken Ka-Lam Hu: As of February 20th, 2013: 73.5 Million USD

e-fundresearch.com: Do you also manage other funds or mandates?

Ken Ka-Lam Hu: Yes. I manage the following mutual funds (which are available on Bloomberg)

1. BOCHK RMB Bond Fund

2. BOCHK RMB High Yield Bond Fund

3. Asian Dynamic Income Fund

4. BOCHK – World Bank Emerging Markets Bond Fund

In addition, I manage segregated fixed income portfolio mandates of insurance companies and a pension fund.

e-fundresearch.com: What is the total amount of assets you manage currently?

Ken Ka-Lam Hu: Currently I manage a total AUM of USD 2.3 billion plus another USD 5 billion of fixed income assets under advisory.

e-fundresearch.com: How long have you been in the business as a fund manager?

Ken Ka-Lam Hu: I have been managing fixed income assets since 1997 (i.e. the onset of the Asian Financial Crisis). Before that I was a CPA (certified public accountant) working in both China and Hong Kong.

e-fundresearch.com: What are the main steps in your investment process and in which area is your competitive edge to add value to investors?

Ken Ka-Lam Hu: Our investment philosophy can be summarized in four principles:

1. Value for risk (i.e. investing in bonds with yields that are high enough to compensate us for taking risks)

2. A global perspective (i.e. broad understanding of global macroeconomics & geopolitics as what is happening in Europe or US could also impact the local bond markets in Asia and China)

3. A forward-looking approach (i.e. actively identifying and anticipating both risks and opportunities)

4. Benchmark-aware, not benchmark-driven (i.e. actively taking calculated deviations from the benchmark based on the risk appetite of client(s) so as to manage downside risk)

In addition, we are in the unique position to leverage the huge research resources of our parent company, Bank of China (Hong Kong) Ltd which is one of biggest investors in both the onshore and offshore RMB bond markets.

Separately, we have special in-house quantitative and qualitative tools in our investment process that differentiate us from our competitors:

• Internal credit rating with information quality (“IQ”) score

When we analyse a bond issuer’s credit profile, we systematically evaluate the credibility of its financial information and the management.

• In-house Sovereign Risk Analytic Framework

It helps us to evaluate sovereign credit risk as it accounts for a big part of corporate credit spread volatilities in Asia, especially in crisis periods.

• Proprietary global bond database to gauge relative values among the different RMB bond markets.

It helps us to gauge relative values between onshore-offshore markets of China, across the Asian region, a global basis, across the credit rating spectrum and industries.

• Comprehensive credit research with a multitude of face-to-face meetings and the possibility to leverage Bank of China (Hong Kong) Ltd resources

• Propriety Integrated Short-Term Market Monitor to analyze daily market trend factors

It helps us monitor the market’s technical factors for micro-market timing.

e-fundresearch.com: Which benchmark is most relevant and how should investors compare the fund vs. benchmarks or peer groups?

Ken Ka-Lam Hu: We take reference to the following four CNH bond indices (in USD terms) as these are the most recognized CNH bond indices from our point of view:

| Index-Name | Bloomberg Ticker |

| (1) BOCHK Offshore RMB Bond Index | BOCRBOND |

| (2) HSBC Offshore Renminbi Bond Index | HCNHACUM |

| (3) Deutsche Bank S&P/DB Orbit Index | DBCNH |

| (4) Citigroup Dim Sum (Offshore CNY) Bond Index | SBDSBIL |

In addition, we monitor and compare the performance of our fund vs. our main competitors (Morningstar category “Anleihen RMB”).

To evaluate the performance of our fund, investors should compare the fund vs. the above mentioned benchmarks and the Morningstar peer group.

e-fundresearch.com: Which performance did you achieve for the fund YTD and over the past five calendar years in absolute terms and relative to relevant benchmark or other reference indices?

Ken Ka-Lam Hu:

Absolute performance:

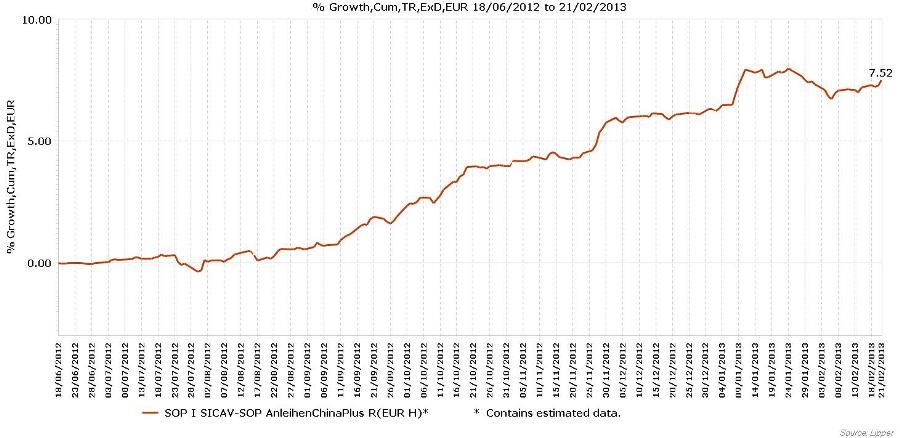

EUR hedged share classes:

• Retail (LU0776283714): YTD 2013: +0,90% /

since inception (06/18/2012): +7,28%

• Institutional (LU0776284365): YTD 2013: +0,97% /

since inception (06/18/2012): +7,80%

USD share classes:

• Retail (LU0776284522): YTD 2013: +0,96% /

since inception (06/18/2012): +7,56%

• Institutional (LU0776284365): YTD 2013: +1,07% /

since inception (06/18/2012): +8,12%

Relative performance (i.e. outperformance vs. benchmark) in USD terms

USD share classes:

• Retail (LU0776284522):

YTD 2013: (1) -0,38%; (2) -0,08% ; (3) -0,08% ; (4) -0,48%

since inception (06/18/2012): (1) +0,15%; (2) +1,34%; (3) +1,77%; (4) +3,33%

• Institutional (LU0776284365):

YTD 2013: (1) -0,27%; (2) +0,03% ; (3) +0,03 ; (4) -0,37%

since inception (06/18/2012): (1) +0,71%; (2) +1,90%; (3) +2,33%; (4) +3,89%

As there are no EUR hedged reference indices, we relinquish to compare our EUR hedged share classes with an RMB index in EUR terms as this would be misleading and not precise.

All figures as of Februar 20th, 2013.

e-fundresearch.com: Which other profession would you have considered apart from becoming a fund manager?

Ken Ka-Lam Hu: Teaching and studying. As a part-time work in the past, I used to teach Fixed Income Investments in a bachelor degree program of the Hong Kong University of Science and Technology and accounting courses for the Chinese University in Hong Kong on Saturdays. I enjoy exchanging my thoughts with others. However, I stopped the part-time work when my son was born.

e-fundresearch.com: Many Thanks!

Fund-development since launch

Performanceergebnisse der Vergangenheit lassen keine Rückschlüsse auf die zukünftige Entwicklung eines Investmentfonds oder Wertpapiers zu. Wert und Rendite einer Anlage in Fonds oder Wertpapieren können steigen oder fallen. Anleger können gegebenenfalls nur weniger als das investierte Kapital ausgezahlt bekommen. Auch Währungsschwankungen können das Investment beeinflussen. Beachten Sie die Vorschriften für Werbung und Angebot von Anteilen im InvFG 2011 §128 ff. Die Informationen auf www.e-fundresearch.com repräsentieren keine Empfehlungen für den Kauf, Verkauf oder das Halten von Wertpapieren, Fonds oder sonstigen Vermögensgegenständen. Die Informationen des Internetauftritts der e-fundresearch.com AG wurden sorgfältig erstellt. Dennoch kann es zu unbeabsichtigt fehlerhaften Darstellungen kommen. Eine Haftung oder Garantie für die Aktualität, Richtigkeit und Vollständigkeit der zur Verfügung gestellten Informationen kann daher nicht übernommen werden. Gleiches gilt auch für alle anderen Websites, auf die mittels Hyperlink verwiesen wird. Die e-fundresearch.com AG lehnt jegliche Haftung für unmittelbare, konkrete oder sonstige Schäden ab, die im Zusammenhang mit den angebotenen oder sonstigen verfügbaren Informationen entstehen.