For the Remain campaigners, the ruling brings renewed hope that Brexit may be thwarted. But it also casts considerable doubt over how events will unfold. Theresa May’s Government had previously promised that ‘Brexit means Brexit’, and to trigger Article 50 by the end of March 2017. That now looks less likely, especially as an appeal has been lodged to the Supreme Court. Ironically, should the Supreme Court be unable to resolve the matter, the dispute could end up being settled at the European Court of Justice.

In market news, the FTSE 100 is on track for its worst week since early January. It’s a similar story in the US, where equity and bond markets are under intense pressure ahead of the presidential elections. If the S&P 500 falls again today, it will be the longest losing streak since 1980.

Facebook flatters but shares fall

The social media giant saw its net income triple over the third quarter. Results were better than expected, beating analyst expectations on revenue and earnings. Yet despite the good news, Facebook’s share price fell by a substantial 8% in after-hours trading. The group warned that ad limits for users newsfeeds would hit revenue growth ‘meaningfully’ in 2017.

Hawkish or cautious?

The Bank of England (BoE) isn’t sure which direction to move next. And nor are markets. The UK economy has performed surprisingly well since the Brexit vote; household spending has been robust, with consumers shrugging off Brexit-related concerns. Inflation is on the rise, however; the BoE is forecasting its 2% target will be surpassed as early as spring next year, and doesn’t expect the figure to fall back in line until 2020. Given the collapse in sterling, the Bank might be wary of raising rates too quickly, as consumer confidence could take a hit when higher prices for imported goods feed through to consumers.

The final showdown: Trump or Clinton

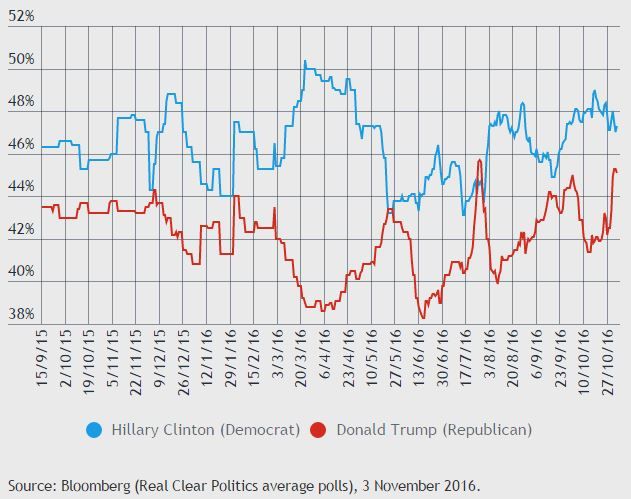

For those who thought the US presidential race had gone a bit stale recently, look again; the polls continue to tighten ahead of next week’s historic decision. Hillary Clinton appeared home and dry in the White House, but news that the FBI had reopened its investigation into her use of a private server for confidential emails has thrown a spanner in the works.

Donald Trump, meanwhile, continues to defy expectations. The Republican mogul is fighting hard with a last ditch attempt to win some key states including North Carolina - a crucial battleground for the two candidates. It’s a close call, but the bookies still have Clinton as favourite to become the 45th president of the United States.

And finally …

Two Australian pranksters managed to bluff their way into a prestigious 18-hole international golf tournament in North Korea. Initially on a polo trip in Beijing, the pair heard about the tournament in a local bar and decided to pose as world-class professional golfers. Ditching the jodhpurs for some authentic looking green blazers bearing the Aussie national logo, the two were chaperoned throughout the 5-day trip, staying in swanky hotels and posing for various photos. Suspicions arose soon after the first ball was hit, however. The caddies were less than impressed, but the Supreme Leader will be relieved that his father’s supposed world-record 38 under par didn’t come under threat on home turf.