MSCI and FTSE Russell are increasing the inclusion of China A-shares in key indices, sending an unequivocal message about the index providers' (and institutional investors') confidence in China. What does it mean for international investors?

Indices Broaden China-A Inclusion

A year after the initial inclusion of China A-shares in the MSCI indexes, MSCI has initiated a three-step process to lift the China A-shares inclusion factor from a symbolic 5% to a meaningful 20% by the end of November 2019. The index provider will also broaden the scope of inclusion to midcap and ChiNext stocks.

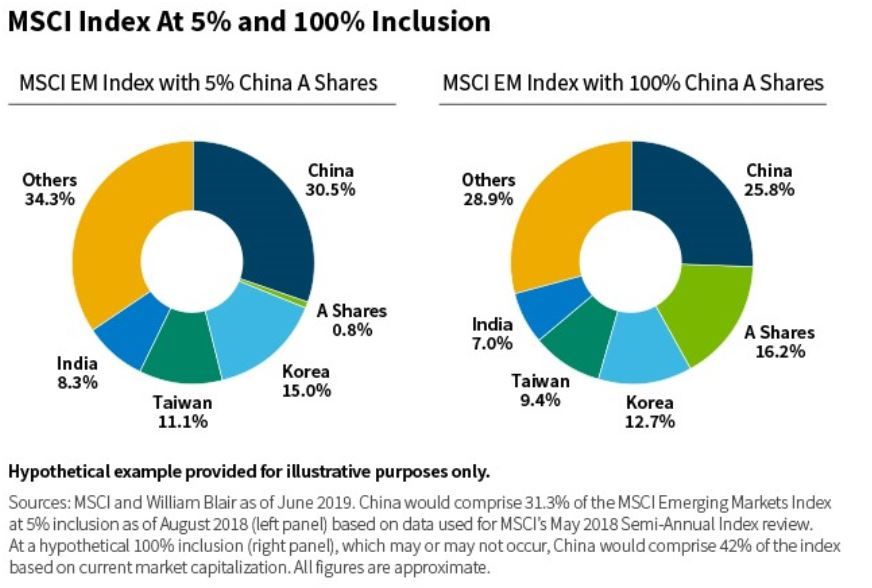

This is expected to boost the overall weighting of China A-shares in the MSCI Emerging Markets Index from less than 1% at the beginning of 2019 to over 3% by November 2019.

Meanwhile, FTSE Russell will begin to include China A-shares in its FTSE Global Equity Index Series (GESI) in June 2019.

The planned inclusion is expected to take place over three steps, ending in March 2020 with a 25% inclusion factor. The approximate weighting of China A-shares in the FTSE Emerging Index will be 5.5%.

Decision Backed by Reforms

Both index providers' decision to include China A-shares in these indices was backed by continued reforms by Chinese regulators and the recognition of the improved accessibility and transparency in China's domestic markets.

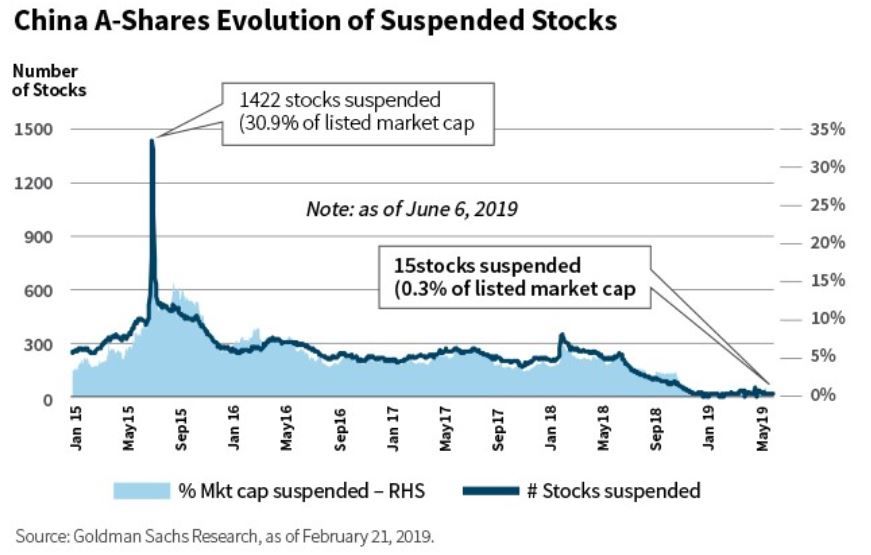

As an example, the stronger framework for trading suspension—a key concern for international investors—led to a significant decline in stock suspensions, as shown in the chart below.

Changes to Connect quotas (including a sharp increase in the daily Connect quota and the elimination of aggregate quota in 2018) and improvements to the Qualified Foreign Institutional Investor (QFII) program are additional examples of improved market investability.

In addition, overwhelmingly positive feedback from international institutional investors regarding the initial 5% inclusion of China A-shares was a catalyst for MSCI's decision to accelerate the increase in the China A-shares inclusion factor to 20%.

1. Implications for International Investors

What do these steps by MSCI and FTSE Russell mean for international investors?

Think Long Term and Get Ahead of the Curve

A direct implication of the increased inclusion of China A-shares in broader indices is the significant amount of flows that are expected to be directed into these markets.

Analysts estimate that between $70 billion and $120 billion is likely to flow into China A-shares from passive and active funds.

According to Goldman Sachs research, approximately 45% of the largest emerging market funds did not have any China A-share investments at the end of 2018. And the weighting of China A-shares across all funds was well below the expected weighting in the index at the end of November 2019 for MSCI and March 2020 for FTSE Russell.

Not only is there potential to close the gap to the index weight at the 20% and 25% inclusion factor (for MSCI and FTSE, respectively), but there is also the possibility of continued increased China A-shares weighting in the indices over time.

2. Exploit the Potential Benefits for Your Broader Portfolio.

At full inclusion, China is likely to reach more than 40% of the MSCI Emerging Markets Index.

While this concentration may raise concerns among investors, it is important to note that offshore shares and A-shares have distinct characteristics. China A-shares is a unique opportunity set with relatively low correlation historically to offshore China and other emerging (and developed) markets.

Indeed, Chinese domestic markets are still largely insulated. With foreign ownership low (approximately 3%), they are driven by retail investors.

As these markets continue to open and attract more sophisticated investors, we expect correlations to slowly increase. However, this is unlikely to materially change the market structure in the foreseeable future given the size of the market and likelihood of increased domestic retail investor participation concurrent with international investor flows.

In sum, at least in the foreseeable future, a higher China A-shares weighting, either in the context of broader emerging market portfolios or through separate China A-shares allocation, should provide further diversification despite higher China macro exposure.

3. Select the Right Approach and Manager.

The increased weighting and ever-growing number of China A-shares in the benchmarks, encompassing smaller-capitalization and ChiNext companies, enhances opportunities for skilled managers to add value given the less efficient nature of the Chinese domestic markets.

It also means that portfolio managers will no longer be allowed to disregard the asset class or hold one or two large and broadly owned stocks to hedge their China A-shares exposure.

We believe having an emerging market manager with the right skill set and China A-shares experience to unlock potential value from this unique market opportunity will be essential.

Within the context of a passive approach, the broader and deeper exposure to China A-shares may also raise institutional investors' concerns about the quality of underlying investments given the large spectrum of operational quality in this vast opportunity set.

We believe an active approach with a disciplined investment process rooted in deep fundamental research and a focus on quality are key to uncovering companies able to deliver sustainably higher returns and avoiding unnecessary risks.

Romina Graiver

Portfolio Specialist

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten