As value managers, we search for companies that exhibit superior capital stewardship and whose management teams are disciplined about creating shareholder value over time.

The Growth Trap

Often, we find that in striving to become larger, small-cap companies fall into the growth-myopic trap of trying to get bigger without creating shareholder value in the process.

The best example of this is when a management team overpays for acquisitions and leverages a company's balance sheet in order to grow the business. In addition to the higher level of debt, this can also lead to future write-downs of goodwill and intangible assets and result in a destruction of shareholder value over time.

To avoid this pitfall, we seek to invest in companies whose management teams are focused on being good stewards of capital and creating shareholder value by improving operational efficiency, asset utilization, and profit margins.

At the same time, we avoid those management teams that have a history of not deploying capital in the best interests of their investors.

Asset utilization is a particularly important component of our research. It simply refers to being more efficient with each dollar of assets a company has—we evaluate this through how a company manages its working capital.

If a company is focused on improving its working capital, it demonstrates that it is focused on the right metrics and staying disciplined with its assets. We believe asset utilization is often overlooked because many investors focus on other fundamental factors or place too much of an emphasis on valuation.

Striking a Balance Between Fundamentals and Valuation

As value investors, we care about valuation. However, we are not deep value managers, who tend to place a disproportionate amount of emphasis on valuation, often looking at companies in sectors that are significantly underperforming. Cheap stocks can get cheaper.

We are relative value managers, so while valuation is important, we also focus on the fundamentals of a company and are not opposed to owning companies that are growing. In fact, we like companies that are growing; it's just a matter staying disciplined in what you pay for that growth.

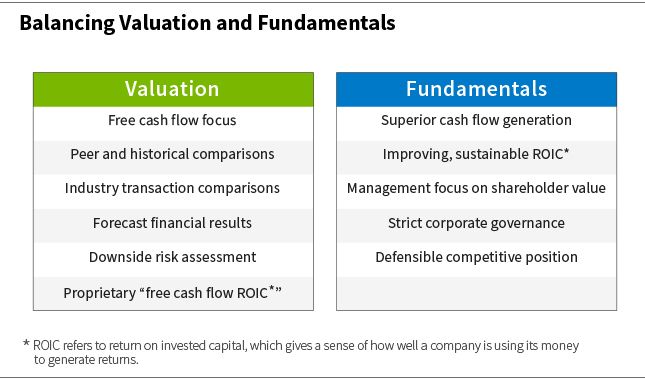

With that, we believe it is important to strike the right balance between valuation and fundamentals by seeking attractively priced opportunities where fundamentals have stabilized or are improving.

To strike a balance between fundamentals and valuation, we use proprietary, company-specific modeling and valuation work to rigorously analyze management's track record of capital stewardship and the company's opportunities to generate returns for shareholders.

We also make sure the stock is attractively valued relative to peers on multiple valuation metrics. We use our company-specific model to engage with management to confirm that it is focused on the same metrics we are looking at and that there is a clear path towards creating shareholder value over time.

High-Quality Bias

A focus on quality is another key component of our investment process. There are many definitions of quality. Generally, we seek companies whose management team is focused on creating shareholder value over time by improving operational efficiency, asset utilization, and profit margins.

We're interested in buying companies that have the ability to generate strong cash flow and return on invested capital (ROIC).

Generally speaking, we are risk averse when it comes to debt. There have been instances when we purchased stocks of companies with higher debt levels, but there needs to be a clear path towards deleveraging the company.

An example is a casino company that was going through a large-scale capital expenditure program to build out their infrastructure around their existing casinos, specifically hotels and parking structures.

That program was ending, and the anticipated cash flow from its business allowed the company to aggressively pay down the debt and bring its leverage back down to more normalized levels.

Our higher-quality bias and being mindful of liquidity translates into us gravitating toward stocks with larger market capitalizations. Some regional banking stocks, for example, are less liquid, so even though we have a lot of conviction in the stock, we may limit the size of our position.

Our focus on higher-quality stocks and those with larger market capitalizations is designed to provide investors with greater downside protection. Historically, these biases have translated into our strategies outperforming during market pullbacks and underperforming in market rallies that favor lower-quality, smaller-cap stocks.

Kicking the Tires

Management meetings are also a critical component of our investment process. In these meetings, we seek to ascertain how committed the management team is to improving the fundamental metrics we look at such as free cash flow and return on invested capital, which define being good stewards of capital and creating shareholder value over time.

Sometimes, we walk away from these meetings with increased conviction. An industrial company we owned, for example, publicly indicated that it had roughly 50 basis points of incremental margin improvement remaining from planned initiatives.

However, after doing additional research on industry trends as well as analyzing the company's internal opportunity set, we believed the opportunity was much larger and that the company's guidance was overly conservative.

Other times, a company might look good on paper, but after meeting with management, we realize it is not focused on the right metrics.

For example, a healthcare services company scored well in our quantitative modeling and the fundamental metrics in our company-specific model looked attractive. However, after speaking with management, we believed it lacked discipline around its ROIC strategy, potentially overpaying for future acquisitions in order to grow the business.

Chad Kilmer, CFA, Partner and Portfolio Manager & Mark Leslie, CFA, Partner andPortfolio Manager, William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten