Over the long run, innovation and productivity gains are the primary drivers of economic growth. While recent economic statistics have been devoid of productivity gains, we believe that artificial intelligence (AI) and machine learning more broadly have placed society on the cusp of large-scale productivity enhancing measures that are already beginning to spur growth across various sectors.

One of the most prominent examples is healthcare, where AI is rapidly redefining what is possible. Recent advances in wound treatment, drug discovery, disease detection, and at-home health screening are promising change like nothing humans have experienced before.

As we enter this exciting new world of healthcare innovation, investors must opportunistically assess what is viable medically and commercially while also assessing threats to existing business models.

Progress Beyond Headlines

The transformation of the healthcare industry is occurring on multiple fronts. AI is enabling research into individual human bodies along with precision medicine and—paradoxically, perhaps—through population-scale databases.

Some of these advancements are already being widely reported on and commercialized—and others are just beginning to take hold.

For example, many have heard about research into clustered regularly interspaced short palindromic repeats (CRISPR). The technology that enables gene editing creates excitement for treating rare debilitating diseases, as well as ethical concerns and downsides that haven't yet been properly debated by society.

But an advancement that was less commonly cited in this year's news coverage may be much more transformative in the near term. Earlier this year, researchers at the University of Toronto medical school developed and showed the efficacy for a 3-D printer of human skin. A small shoebox-like device that weighs about two pounds can effectively graft customized layers of skin on very deep wounds to facilitate healing.

This technology, which exists today and is being commercialized, replaces the need for donor skin in large quantities, which is usually necessary but almost never available. In addition to its ease of use, the printer is transportable and doesn't need to be cleansed or incubated like traditional surgical devices.

This is just one example of how healthcare innovation has the potential to upend the entire process and cost structure from a procedure—hospital costs, patient recovery times, etc. Just imagine the impact if it were applied to internal organs.

Another promising front in the ongoing transformation of the healthcare industry is cancer detection. Companies around the world are working on technology-enabled solutions for early cancer detection, from non- or minimally invasive blood tests to detect and diagnose the type and stage of disease much earlier than is currently possible.

Computing Power Drives Healthcare Innovation

Much of this innovation requires population-scale databases that weren't possible computationally speaking even 10 years ago. And some can eliminate or significantly reduce the early stage drug discovery processes.

Recently, a U.K.-based AI company produced a thesis using large volumes of data in just two weeks. It then previewed its findings to a neuroscience-based laboratory, which validated the thesis. Conventional research methods used in a laboratory took more than two years to come up with the same conclusion that the AI company developed in two weeks.

If you think about drug development time moving from two years of initial research to two weeks, or the timeline for developing pharmaceuticals shrinking from 10 to 15 years to 3 years, that has massive implications for patients—and investors.

Furthermore, today there are companies that can dissect an individual human biome in less than a month for a cost of about $300 to $400. These companies can provide highly individualized prescriptive dietary plans that are specific and unique to address a whole host of scientifically linked chronic diseases, such as autoimmune illnesses, diabetes, and chronic heart conditions.

Early Signs of Larger Financial Impact

In addition to accelerating the research process and transforming the delivery of care, AI-enabled advancements are altering the financial characteristics of the healthcare industry.

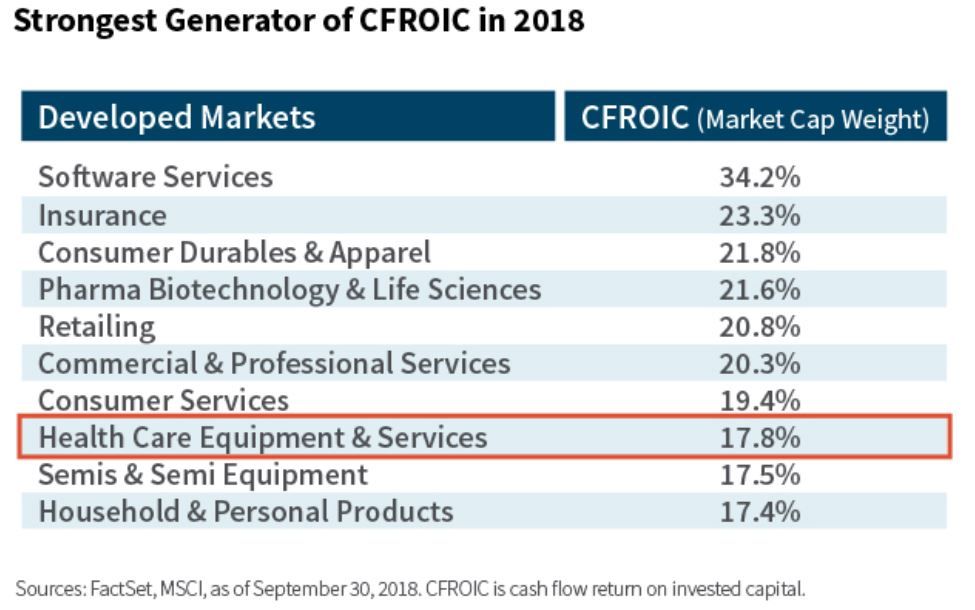

If you look at the exhibit below, you'll see that healthcare equipment and services is No. 7 in terms of cash flow return on invested capital in 2018. This is noteworthy because in 2017 the sector didn't even crack the top 10.

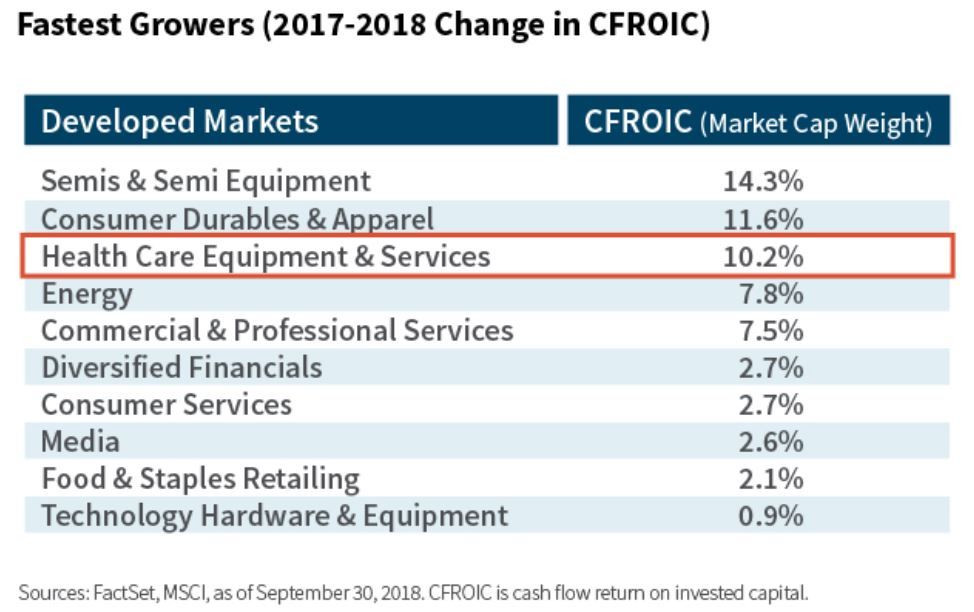

This next chart lists the fastest-growing sectors in terms of cash flow return on invested capital. Healthcare equipment and services is growing at a robust 10.2% clip in 2018 and has been in the top five sectors several years in a row.

We believe that we are still in the early stages of a major transformation that is occurring across the healthcare industry, and the full impact—both in terms of efficacy as well as corporate profitability and returns—won't be seen for some time.

But the initial waves are already apparent, and it will be fascinating to watch this larger story unfold.

To access more insights about how William Blair is reaching beyond traditional investment analysis to think about the white space between asset classes, sectors, geographic regions, and investment teams, we invite you to explore other posts about sessions at our 2018 CONNECTIVITY conference.

Olga Bitel

partner and global strategist on William Blair's Global Equity team

William Blair Investment Management

Tipp: Dieser Beitrag ist auch im "Investment Insights"-Blog von William Blair verfügbar.

William Blair Updates per E-Mail erhalten